PROPERTY BUYING SERVICE

Your Property Buyer’s Agent in Portugal

Buy property in Portugal with Portugalxpert in a one-stop-shop model.

Buy Property in Portugal with Portugalxpert

PROPERTY BUYING

Experience guidance and assistance with our Buyer’s Agents. Our team facilitates the entire process of buying a property in Portugal.

PROPERTY INSPECTION

Our team conducts property inspections in several locations like Lisbon, Cascais, Setúbal, Almada, Santarém, Ericeira, Algarve.

MORTGAGE SUPPORT

Leverage our established ties with most Portuguese banks and financial entities thanks to our partnership with Knowpedia.

PRICING

Our remuneration is derived from the commission paid by the listing agency representing the seller and from banks.

Help us find your ideal Property

MARKET INSIGHT

Property Buying in Portugal

To successfully buy a property in Portugal, most responsibilities lie with the property buyer's agent and legal representative, whether you are physically present in Portugal or not.

Get to know our simplified process:

1. Property Search

Let us streamline your search with advanced tools and off-market contacts, ensuring properties align with your requirements.

2. Curated Listings

We create a list of property selections in your desired locations, honed to match your criteria, so you view only the best fits.

3. Property Viewings

As a sole point of contact, we arrange property viewings with the listing agencies. If you're absent, virtual visits are at your service.

4. Legal Support

Get introduced to proficient English-speaking attorneys or, if preferred, appoint a lawyer of your choice.

5. Property Mortgage

We manage the entire mortgage process with leading Portuguese banks, securing ideal mortgage terms to finance your deals.

6. Property Inspection

General or detailed property inspections using advanced non-destructive testing tools for safer, informed investments.

7. Deed Assistance

We follow up until the end and facilitate the notary’s process as we stand by your side, ensuring smooth property handovers.

8. Renovation Management

Need to upgrade? Lean on our renovation guidance and project management service in certain locations (fee applicable).

9. Property Management

Do you want us to take care of your real estate investments? We provide property management services in certain locations (fee applicable).

Meet the Real Estate Team

-

João Pires (PT)

João is a Property Buyer’s Agent and Certified Mortgage Broker specializing in renovations in Lisbon and surroundings. He holds a Master’s in Management and a postgraduate degree in Building Conservation.

-

Benjamin Seide (GER)

Ben, based in Lagos, Algarve, is a seasoned real estate professional with international experience. Holding an MBA, he specializes in residential properties, new developments, and investments across the Algarve.

-

Rebecca Jane Charles (UK)

Rebecca operates as a Buyer’s Agent in Tavira, Algarve, offering personalized support to international clients. She focuses on guiding buyers through their property search and relocation process in Portugal.

-

Matt Deasy (UK)

Matt, a Harvard Business School alumnus and experienced property developer, helps clients relocate and settle in Portugal. With a background in business management and expat life, he provides relocation consulting.

PORTUGAL BUYER’S AGENT

Why do you need a Property Buyer’s Agent?

Buyer’s Agents work exclusively for buyers, searching properties, negotiating prices, and closing deals while safeguarding the buyer's interests. They bring an extra level of scrutiny and objectivity to the process, providing a much-needed layer of security.

IMPARTIAL ADVICE AND GUIDANCE

In Portugal, agents often represent both buyers and sellers, focusing on their agency’s listings. This creates a conflict of interest, making independent Buyer’s Agents increasingly essential, especially in competitive markets.

WAY TO AVOID COMMON MISTAKES

Without local expertise, buyers risk purchasing properties in unsuitable areas, underestimating renovation needs, or misjudging a property’s condition. Relying on knowledgeable professionals helps avoid these pitfalls.

ONE-STOP SHOP MODEL

An experienced agent with expertise in property sourcing, deal analysis, mortgage advice, and property inspections streamlines the buying process. A holistic approach minimizes touchpoints and ensures a smooth transaction.

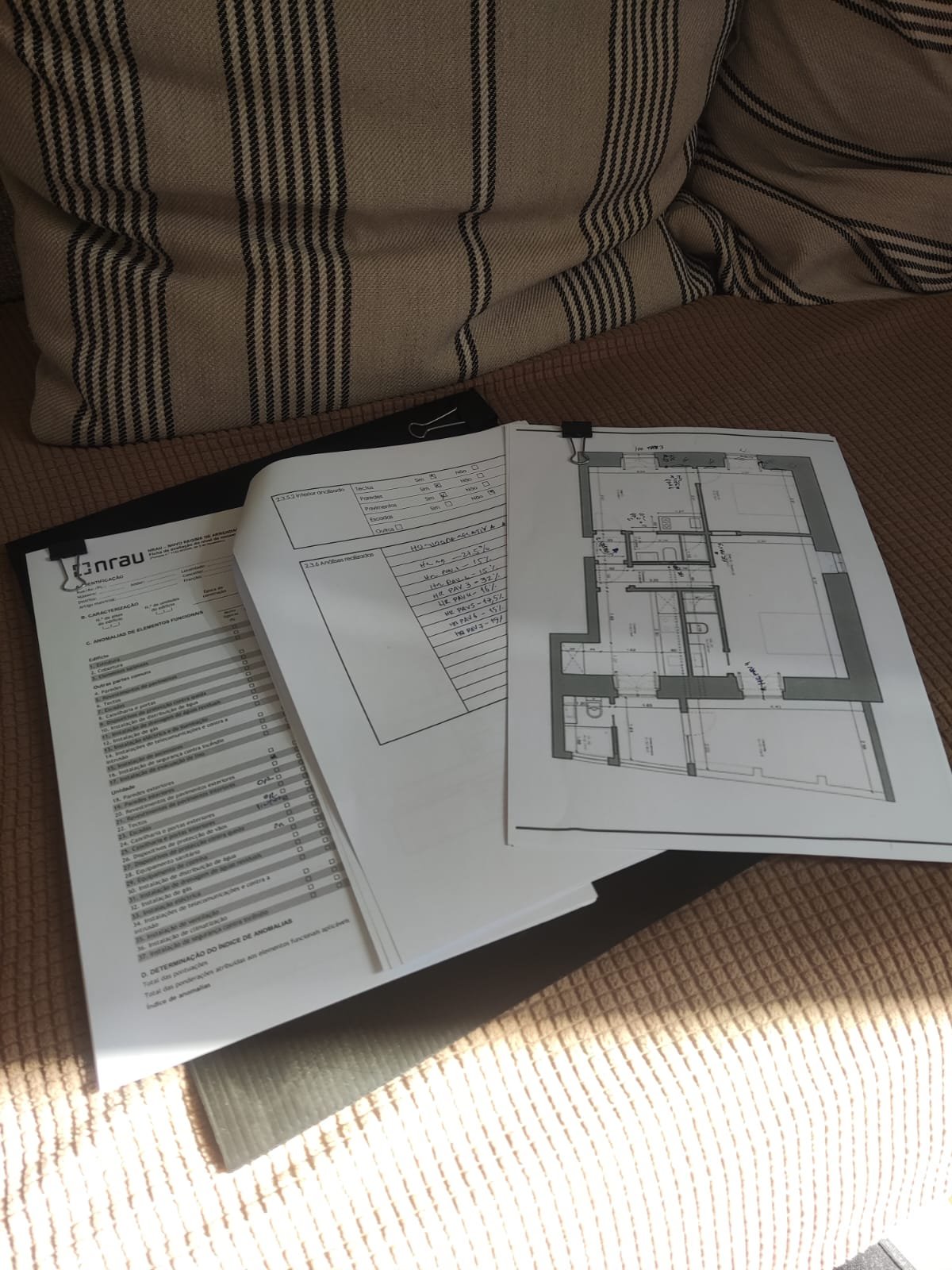

Property Inspections

We provide property inspection services, offering general assessments during viewings and detailed evaluations by our civil engineer if needed. Using non-destructive testing tools like moisture meters, thermography, and rebar detectors, we help uncover potential issues, ensuring a safer and more informed property investment.

Types of Properties in Portugal

An important step is to be aware of the variety of homes in Portugal. Find the perfect match for your lifestyle and preferences as you explore the unique features of each property type.

Apartment

Apartments in Portugal, commonly located in city centers, range from compact studios to luxury units with modern features. They provide easy access to urban conveniences such as cafes, theaters, and shops, making them ideal for young professionals and small families.

Townhouse

Multi-level townhouses offer a balance of privacy and practicality. Found in residential communities, they require less maintenance than detached houses and often include shared amenities like pools and playgrounds, appealing to families and couples.

Detached House/ Villa

Detached houses and villas offer spacious living with features like private pools, gardens, and multiple bedrooms. They are typically located in suburban or rural settings, providing privacy and comfort at a higher cost.

Country House

Country houses in Portugal blend traditional architecture with modern comforts. Located in peaceful rural areas, they offer ample space for gardening, outdoor activities, and relaxation, perfect for those seeking tranquility away from urban life.

Beach House

Situated along Portugal’s coastline, beach houses are popular for vacation homes or investment properties. They often feature ocean-view terraces, beach access, and a laid-back seaside ambiance, making them highly desirable for tourists and seasonal residents.

What our Clients are Saying

Questions? Get in touch!

Contact us via email at hello@portugalxpert.com or drop us a message via the form below.

FAQs

-

When considering purchasing property in Portugal as a foreigner, here are the key points to note:

Type of Housing: Portugal offers a diverse range of properties, including land plots, apartments, houses, townhouses, condos, and luxury villas.

Location and Pricing: The property's location heavily influences its price. City centers like Lisbon and Porto, as well as oceanfront regions like Cascais, Lisbon South Bay, and the Algarve, tend to have pricier properties. Your budget will largely depend on the exact location and your housing preferences.

Foreigner Restrictions: There are no specific restrictions imposed on foreigners wishing to buy property in Portugal.

VAT Identification Number: One essential requirement for foreigners is obtaining a VAT identification number, known locally as the NIF (Número de Identificação Fiscal or Número de Contribuinte). This can be acquired by either opening a bank account in Portugal or visiting a tax office in the country.

-

Following the global financial crisis in 2008, Portugal’s property market faced significant challenges, with falling prices and hesitant buyers. However, by 2014, the economy began to recover, thanks to infrastructure investments and foreign-friendly policies. Today, homes for sale in Portugal are in high demand, especially among foreign buyers seeking investment opportunities or residency options.

-

The Portuguese real estate market is thriving, driven by both local and international demand. The country has become a hotspot for foreign investors, retirees, and tech professionals, thanks to its attractive previous Golden Visa program and Non-Habitual Resident tax regime. Demand for properties, especially in cities like Lisbon and Porto, often outstrips supply, making it a seller’s market.

-

Buying property in Portugal is often a relationship-driven process. It begins by working with a local real estate agent who understands your preferences and can guide you through available properties for sale. Unlike North America, where property transactions can be fast and transactional, the process in Portugal might take several months as you explore options and narrow down your choices.

-

Yes, foreigners can apply for mortgages in Portugal. Many Portuguese banks offer loans to non-residents, typically covering up to 70% of the property's value. The terms of the loan will depend on factors such as your income, the type of property, your age, your residency status, among others. It’s advisable to consult with a buyer’s agent and a mortgage broker to explore your options.

-

When buying a home in Portugal, it’s essential to evaluate your financial health carefully. Start by assessing your income stability—whether you’re on a steady payroll or have variable earnings. Banks generally cover 70-80% of the property value, meaning you’ll need a substantial down payment. For non-residents, financing options may be more limited. It’s also important to calculate your debt-to-income ratio, which should ideally be under 35-40%. This includes your mortgage and other loan payments.

-

Deciding between buying and renting depends on your personal and financial situation. Buying offers long-term investment potential, especially in high-demand areas like Lisbon and Porto, where real estate tends to appreciate. However, renting provides flexibility if you’re unsure about staying long-term or want to explore different areas before committing. Many expats rent first while saving for a future down payment on a house for sale in Portugal.

-

Urban centers like Lisbon and Porto are known for their competitive markets, with higher prices and more demand. These cities attract both local and international buyers, leading to potential appreciation over time. In contrast, rural areas, such as Alentejo or Central Portugal, offer more affordable property for sale and a slower-paced market. The choice between city and rural life depends on your lifestyle preferences and investment goals.

-

Housing prices in Portugal have steadily increased, particularly in urban centers. From May 2022 to May 2023, prices rose by 6.5%, with areas like Lisbon seeing even sharper increases—up to 10-15% in some cases. Homes for sale in Lisbon now command prices around 340% higher than those in rural areas. Despite these increases, Portugal remains an appealing option for international investors due to its potential for continued appreciation.

-

The Portuguese government has recently discontinued the Golden Visa program via real estate acquisition, which had previously driven significant foreign investment in Portugal real estate. While this attempted to control international investment, properties for sale in Portugal remains in high demand, particularly in Lisbon and coastal regions. Investors are still drawn to the country's overall stability, tax benefits, and potential for long-term appreciation.

-

As inflation rises, the European Central Bank (ECB) may raise interest rates, which could impact variable interest mortgages. This would result in higher monthly payments for buyers with variable rate loans. However, recent interest rate drops (in 2024), attracted buyers due to the potential for high rental yields and long-term investment returns.

-

Market research is essential for understanding the dynamics of the Portugal real estate market, such as property prices, trends, and regional variations. This helps buyers make informed decisions, avoid overpaying, and identify the best locations based on their lifestyle preferences.

-

Portugal is known for its safety, but some areas may have higher crime rates than others. Research local crime statistics and visit the neighborhoods to get a feel for the safety and community. Your lifestyle preferences also matter—areas like Bairro Alto in Lisbon are lively and full of nightlife, while quieter regions like Alentejo or certain suburbs may offer a more peaceful environment.

-

To start your search, online property portals like Idealista, Casa Sapo, Imovirtual, and CasaYes are the most popular platforms in Portugal. These websites offer a variety of filters for location, price range, and property type, making it easier to find homes for sale in Portugal that meet your needs. Keep in mind that some listings may not always be up-to-date, so it's essential to verify availability with your real estate agent or buyer’s agent.

-

Portugal does not have a centralized Multiple Listing Service (MLS), unlike countries like the USA. This means you may encounter duplicated listings, outdated information, or properties that are already sold but still appear online. It's crucial to work with a buyer’s agent who can help you navigate the listings, check availability, and ensure the information you receive is accurate and current.

-

While square meter pricing is commonly used to evaluate properties, it's important to consider other factors such as location, the number of windows, views, and the quality of services in the area. In city centers like Lisbon, properties close to amenities or with better views may command higher prices. Doing thorough research is key to understanding these nuances when searching for properties in Portugal.

-

In Portugal, private listings are relatively rare compared to agency listings. Most properties are sold through agencies, which provide professional support throughout the buying process. It’s possible to rely on private listings but, we strongly recommend to be extra cautious in these cases and working with an agency or buyer’s agent, as they can add a layer of security and scrutiny.

-

A physical property viewing is crucial to ensure the property matches the listing. This allows you to spot potential issues that might not be mentioned online, such as dampness, outdated electrical systems, or lack of insulation. Viewing the property in person gives you the chance to verify the condition and confirm it meets your expectations before making a final decision.

-

When conducting property viewings, be sure to ask when the property was last renovated, if any recent repairs were made, and whether the seller or landlord plans to make updates before the sale or tenancy begins. For shared spaces, like condos with communal areas or amenities, inquire about maintenance responsibilities and costs.

-

Technical due diligence, also known as a building inspection, is an evaluation of the property’s physical condition. While not common in Portugal, this inspection is highly recommended. A professional inspector or engineer will assess the structure for issues like foundation problems, water damage, and structural deficiencies, helping you avoid unexpected repair costs after purchasing the property. We are able to conduct property inspections.

-

Legal due diligence ensures that the property is free of legal issues, such as outstanding debts, condominium disputes, or illegal constructions. A lawyer will review the property’s documentation, confirm that the physical situation aligns with the legal description, and check that all required licenses are in place. This process is crucial to protect you from potential legal complications down the line. Our lawyers conduct legal due diligences.

-

The user license confirms the legality of the property’s construction. If a building was constructed or renovated without proper authorization, the owner could face fines, or in extreme cases, be required to demolish illegal structures. Ensuring the property has a valid user license is a key part of the legal due diligence process and prevents future legal or financial problems.

-

In Portugal, offers are typically facilitated by the real estate agent representing the seller. The buyer’s agent will communicate your proposal, including the purchase price and terms, to the listing agent. This structure allows for smooth negotiation, ensuring both buyer and seller are informed and comfortable with the terms before finalizing the sale.

-

A comprehensive offer should include the purchase price, deposit amount, financing terms, proposed closing date, and any contingencies, such as a home inspection. These elements help the seller evaluate your commitment and ensure that both parties are clear on the conditions. It’s common for offers to also outline any items included in the sale, like furniture or appliances.

-

In Portugal, the deposit amount—often called earnest money—is typically between 10-20% of the agreed purchase price. This deposit demonstrates your commitment to the seller and is generally held until the sale is finalized. A strong deposit can make your offer more competitive, especially in high-demand areas.

-

Getting pre-approved for a mortgage shows the seller that you’re financially prepared and serious about purchasing the property. It strengthens your offer by reducing uncertainties related to financing and may give you an edge in competitive situations, especially in markets with high demand.

-

Market conditions—whether it’s a buyer’s or seller’s market—play a key role in crafting an offer. In a seller’s market, where demand outpaces supply, you may need to offer above the asking price to stand out among buyers. Conversely, in a buyer’s market, there may be more room to negotiate the purchase price.

-

The closing date can often be negotiated to accommodate both the buyer’s and seller’s timelines. Typically, the date accounts for the time needed to secure financing and complete necessary paperwork, being 90 days the most common case.

-

In a seller’s market, as seen in high-demand areas like Lisbon, sellers often have more leverage due to limited supply. This may require buyers to be more flexible with their conditions to secure the property. Conversely, in a buyer’s market, there is usually more room to negotiate on price and terms.

-

The condition of the property can be a strong negotiation point. For example, if the home requires extensive repairs or updates, you may be able to negotiate a lower purchase price or request certain repairs be completed before closing. This is particularly relevant when looking at older homes for sale that may require modernization.

-

If you plan to use mortgage financing to buy property, being pre-approved can strengthen your offer. Sellers often prefer buyers who have secured financing, as it reduces the risk of the sale falling through. In competitive markets, having pre-approved financing can also make your offer more attractive compared to buyers without guaranteed funding.

-

The primary purpose of a Reservation Agreement is to reserve the property for sale for a specific buyer, ensuring that the seller does not entertain other offers. This agreement allows the buyer to proceed with necessary steps like securing financing and completing legal checks without the risk of losing the property to another buyer.

-

Typically, the reservation fee in Portugal is non-refundable. This means if the buyer decides not to go through with the purchase for reasons not stipulated in the agreement, the fee is forfeited. However, if there are undisclosed legal issues or the seller fails to meet the agreed conditions, the reservation fee may be refunded.

-

A Reservation Agreement should only be signed when you are fairly certain about proceeding with the purchase. Situations that warrant this include securing a high-demand deal, having financing pre-approved, completing initial due diligence, or finding unique features that make the property especially desirable.

-

A Reservation Agreement provides a level of commitment from the seller, removing the property from the market. However, the purchase is only finalized after the formal sales contract is signed. The Reservation Agreement helps secure your interest in the property, but full ownership is only transferred at closing.

-

The Promissory Agreement, or Contrato de Promessa de Compra e Venda (CPCV), is a legally binding document that outlines the terms and conditions of the property sale. While not mandatory, it’s widely used to secure the commitment of both buyer and seller, ensuring each party adheres to the agreed-upon terms until the final sale.

-

The agreement should clearly outline the sale price, payment method, property details, and any specific conditions, such as required property updates or agreed-upon inclusions. Including these details in the Promissory Agreement ensures transparency and protects both the buyer and seller by defining responsibilities upfront.

-

A mortgage contingency clause allows buyers to back out of the Promissory Agreement without penalty if they cannot secure financing. This clause is particularly valuable for buyers seeking a mortgage in Portugal, as it provides an exit in case financing is denied.

-

If the seller fails to comply with the Promissory Agreement, they may be required to pay the buyer twice the amount of the down payment as compensation. Conversely, if the buyer does not fulfill their obligations, they typically forfeit their down payment. These measures ensure accountability for both parties in the transaction.

-

Unlike the USA, Portugal does not use an escrow system. Instead, upon signing the Promissory Agreement, the down payment is transferred directly to the seller or estate agency. This makes it essential to have a carefully crafted agreement that protects both buyer and seller throughout the process.

-

Yes, securing pre-approval from a bank strengthens your position and increases confidence in the transaction. With pre-approval, you’re better prepared to proceed with the Promissory Agreement and ensure you have financing in place for the property.

-

The Property Deed (Escritura de Compra e Venda) is the official document that transfers ownership of the property from the seller to the buyer in Portugal. Prepared and signed before a notary, this legally binding document completes the property transaction, making the buyer the official owner.

The Property Deed is mandatory for officially transferring real estate in Portugal. It formalizes the sale, ensuring that both parties agree to all terms. Without this step, ownership is not legally transferred. -

On the signing day, the balance of the purchase price is typically paid to the seller through a bank cheque. This payment only occurs once the Property Deed is successfully signed, confirming that the buyer now legally owns the property.

-

When finalizing the purchase of a property at the Property Deed (Escritura de Compra e Venda) signing, the seller must provide a set of essential documents:

- Urban Property Booklet (Caderneta Predial Urbana)

- Land Registry Certificate (Certidão de Teor or Certidão de Registo Predial)

- Technical File of the Property (Ficha Técnica de Habitação)

- Energy Efficiency Certification (Certificado Energético)

- License of Use (Licença de Utilização)

- Condominium Declaration (Declaração de Despesas de Condomínio) -

The Urban Property Booklet (Caderneta Predial Urbana) provides important fiscal information about the property, including its location, composition, fiscal value, and ownership details. It’s a critical document presented at the Final Deed signing to confirm the property’s official record.

-

The Land Registry Certificate verifies the property’s legal status and confirms ownership, ensuring there are no undisclosed liens or legal claims. This certificate is essential for a secure transaction, as it guarantees the buyer is purchasing a property free of legal issues.

-

The Technical File of the Property (Ficha Técnica de Habitação) details the property’s technical specifications, such as construction materials and installed equipment. This document gives the buyer insight into the quality and structure of the property, ensuring transparency during the purchase.

-

The Energy Efficiency Certification rates a building’s energy performance, helping buyers understand potential utility costs and the property’s environmental impact. It’s legally required for all property sales in Portugal and must be presented during the Final Deed process.

-

The License of Use (Licença de Utilização) confirms the intended use of the property (e.g., residential or commercial). This document is necessary for legal compliance, ensuring the buyer is fully aware of the permitted property use and avoids future issues related to zoning or purpose.

-

A Condominium Declaration is mandatory when the property is part of a condominium, verifying that the seller has paid all outstanding condominium fees. This document ensures there are no unpaid expenses that could transfer to the buyer after the Final Deed is signed.

-

In Portugal, property valuation is often based on a per-square-meter rate, but this metric doesn’t capture all factors affecting value. Unlike countries with a centralized Multiple Listing Service (MLS), Portugal lacks a standardized database for tracking listings and historical sales data. This means factors like location, natural light, and nearby amenities play a significant role in property valuation, especially in high-demand areas like Lisbon and Porto.

-

Dual agency representation is common in Portugal, where real estate agents may represent both buyers and sellers. This setup can sometimes limit transparency in negotiations and may lead to commission-sharing conflicts. As a buyer, you may interact with multiple agents from various agencies, which can make the process complex and challenging to manage.

-

In Portugal’s open market, dealing with multiple agents from various agencies is common, especially since agents may represent both parties. Employing a buyer’s agent provides a centralized point of contact, reducing the complexity of managing multiple relationships and ensuring a more streamlined process.

-

Portugal has strict regulations regarding property construction and alterations. Zoning laws determine the type of structure allowed in specific areas, such as residential, commercial, or industrial. Additionally, buildings designed for one purpose, like residential use, typically cannot be converted to commercial or mixed-use without approval, ensuring properties adhere to safe and sustainable practices.

-

Not all alterations are permitted without approval. In Portugal, significant changes—such as adding an extension, constructing another floor, or modifying the façade—require permission from the local municipal authority (Câmara Municipal). Alterations made without these permits could result in fines and the requirement to restore the property to its original state at the owner’s expense.

-

For interior renovations that don’t alter the property’s exterior or original layout, usually, all that’s needed is to notify the Câmara Municipal about the project start date. However, any significant interior changes, like reconfiguring the layout or adding structural elements, may require submission of a project plan by a certified architect or engineer for municipal approval.

-

Zoning rules in Portugal dictate the designated use of properties (e.g., residential, commercial) within specific areas, and it’s not always easy to change a property’s designated purpose. If you plan to use a house for sale in Portugal as a commercial space, for instance, you would need approval from the local council, as zoning laws restrict changes to maintain community standards and safety.

-

Hiring a lawyer familiar with Portugal’s real estate regulations can be highly beneficial, especially if you plan to make property alterations. A lawyer can confirm any restrictions, validate the property’s legal standing, and guide you through obtaining necessary permissions, ensuring a smoother buying process and compliance with local laws.

-

A financial consultant provides strategic financial advice, often helping investors evaluate potential returns and structure deals for maximum profitability. They may offer services like investment modeling and business case construction, which can be especially beneficial for those interested in real estate investment in Portugal rather than just buying a home.

-

Yes, using both professionals can be highly effective. An estate agent assists with finding suitable properties and handling negotiations, while a financial consultant provides a financial perspective, ensuring the investment aligns with long-term goals. This combined approach offers a comprehensive view, benefiting both residential and investment-focused buyers.

-

In Portugal, negotiations go beyond straightforward transactions and include an understanding of cultural subtleties. The Portuguese value politeness, respect, and patience, so approaching negotiations with these values in mind can lead to a more positive outcome. Unlike in some countries, overbidding is not typical, though it may occur in high-demand areas like Lisbon and Porto.

-

Cash offers can provide a competitive edge, as sellers may prefer the certainty of immediate payment over waiting for bank loan approval. For buyers without cash liquidity, obtaining pre-approval for a mortgage before negotiating is recommended, as it shows financial readiness and can enhance the offer’s appeal.

-

Mortgage pre-approval demonstrates financial readiness, which is appealing to sellers. It shows that you’re serious about the purchase and prepared to move forward without delays, giving your offer additional weight in negotiations, especially in high-demand areas.

-

Avoid overly aggressive tactics, as Portuguese culture values patience and respect in negotiations. Rushing or pushing too hard can be seen as disrespectful and might harm the negotiation process. Allow your buyer’s agent to guide you, as they understand the cultural expectations and can help you negotiate effectively.

-

Property ownership transference is the legal process of updating the official records to reflect you as the new owner of the property. This step occurs after signing the Final Deed and is crucial to establish your legal ownership of the property, ensuring that your name is registered with the land registry and tax authorities.

-

The land registry is responsible for updating ownership records to reflect the new buyer. They communicate the ownership change to tax authorities, which is essential for tax compliance. Regular follow-up with the land registry can help you confirm that the ownership transference process is progressing as expected.

-

Yes, delays in property transference can create complications, especially with property taxes. If your ownership is not registered promptly, tax obligations may still be linked to the previous owner, leading to confusion or potential penalties. Ensuring timely transference helps you avoid these legal issues. If there is a delay, it’s advisable to visit the tax authorities and personally confirm the ownership change.

-

A final property visit allows the buyer to confirm that the property is in the same condition as outlined in the final deed and property documents. This step ensures there are no new damages or changes, providing peace of mind that the property matches the agreed-upon condition at handover.

-

If discrepancies are identified during the final visit, document them immediately and notify your buyer’s agent or lawyer. They can help negotiate with the seller to resolve the issues or make adjustments, ensuring the property matches the agreed terms.

-

IMT, or Property Purchase Tax, is a tax applied to the transfer of property rights in Portugal, covering all types of real estate including land, houses, apartments, and commercial properties. This tax is based on the property’s value and varies depending on factors like the type of property (primary or secondary residence), location, and taxable property value.

-

IMT rates in Portugal are variable and depend on several factors, including the property’s category, location (mainland Portugal or autonomous regions), and value. For a primary residence, the tax rate ranges from 0% to 8%, based on the property’s fiscal value or acquisition price, whichever is higher. Mainland properties and those in autonomous regions have distinct rate thresholds.

-

IMT is typically paid on or just before the Final Deed signing day. It's not advisable to pay the tax far in advance, as delays or cancellations in the deed signing could complicate the refund process. Ensuring payment aligns with the final steps in property acquisition is key to a smooth transaction.

-

The IMT is calculated using a formula based on the property’s acquisition value or taxable property value (whichever is higher), multiplied by the applicable tax rate, then subtracting a deductible amount. The calculation is specific to each property type and value bracket, so it’s beneficial to consult updated rate tables on Portal das Finanças for precise rates.

-

Stamp Duty, or Imposto de Selo (IS), is a tax on property transactions and certain non-VAT transactions in Portugal, applied at a rate of 0.8% on the higher value between the property’s acquisition price and its taxable property value (VPT). This duty is typically paid at the time of the final deed signing with the notary, finalizing the property transfer and ensuring compliance with Portuguese property tax regulations.

-

For real estate purchases, Stamp Duty is calculated at a flat rate of 0.8% on the higher amount between the property’s acquisition value and its VPT (taxable property value). In addition to the property deed, Stamp Duty applies to related documents such as contracts, mortgages, and titles, ensuring all official records are properly taxed and validated during the transaction.

-

IMI is an annual Municipal Property Tax in Portugal, levied on the taxable property value (VPT) to fund local municipalities. The IMI rate varies by municipality, property type, and the year the property was built. For example, a property in Lisbon with a VPT of €150,000 and a 0.675% tax rate would incur an IMI of €1,012.50, which can be paid in up to three installments depending on the total amount.

-

IMI is due each year based on property ownership as of December 31st. The payment structure allows for installments based on the total tax due: properties with IMI under €250 require a single payment, amounts between €250 and €500 allow for two installments, and amounts exceeding €500 can be paid in three installments.

-

AIMI, or Wealth Tax, is an additional annual tax on residential properties and construction land in Portugal with a taxable property value (VPT) exceeding €600,000. It applies to both residents and non-residents. Individual owners are taxed at 0.7% on property values above €600,000, with an increase to 1% on values over €1 million. Co-owned properties enjoy a combined exemption of €1.2 million, making AIMI relevant primarily for high-value properties or portfolios. Source: Page 17 of Sistema Fiscal Português

-

Rental income in Portugal is taxed differently based on residency. Resident taxpayers can choose to add rental income to their total taxable income under progressive rates or use an autonomous 25% rate, with the ability to deduct property-related expenses. Non-resident taxpayers are taxed at a flat 25% rate on rental income, with deductions allowed for genuine property expenses, such as maintenance and municipal property tax, as long as they are documented.

-

Resident taxpayers are taxed on 50% of the capital gain, which is added to their annual income and taxed at applicable progressive rates (14.5% to 48%). If the proceeds are reinvested into another primary residence within a specific time frame, the taxable amount may be reduced. Non-resident taxpayers face a flat 28% tax rate on capital gains without the reinvestment benefit.

-

For individual taxpayers, only 50% of the capital gain is taxable, whereas for companies, 100% of the gain is taxable. This makes the effective tax on capital gains potentially higher for corporate entities, impacting the financial outcome for companies investing in Portuguese real estate.

-

The mortgage application process in Portugal begins with obtaining a mortgage quote, often assisted by a mortgage broker. After choosing a quote and submitting required documents, a formal mortgage offer is issued upon approval. The lender will conduct a property valuation, followed by fund transfers for the purchase. The process concludes with signing the property and mortgage deeds in front of a notary, officially transferring ownership to the buyer.

-

Standard documents include a copy of your passport, Portuguese Tax Number (NIF), proof of income, recent bank statements, proof of address, and any existing mortgage statements. Employed applicants should provide payslips and a job contract, while self-employed applicants need business bank statements and financial records. Additional documents, such as proof of savings or investment accounts, are often requested based on individual circumstances.

-

Yes, employed applicants are typically required to provide payslips, a job contract, and last year’s tax returns. In contrast, self-employed applicants need business bank statements, three years of company financials, and proof of consistent income. These tailored document requirements help lenders assess income stability based on employment type.

-

Mortgage applications in Portugal involve several fees, including the Comissão de Dossier (application fee), which ranges from €200-€300, and the Comissão de Avaliação (bank valuation fee), costing €400-€600. Additional costs include around 5%-6% of the purchase price for taxes and notary fees, and a Stamp Duty of 0.60% on the mortgage amount, payable upon completion.

-

A fixed-rate mortgage offers consistent monthly payments over a set period, providing protection against interest rate changes but charging a 2% fee for early repayment. A variable-rate mortgage, the most common in Portugal, varies with the EURIBOR index and has a lower early repayment fee of 0.5%. The mixed-rate mortgage combines fixed and variable terms, often offering stability for 2-5 years with a switch to variable rates later, appealing to buyers looking for flexibility and initial rate stability.

-

When renegotiating a mortgage, focus on factors such as loan amount, which impacts the LTV ratio and bank offers, and loan term, as extending the term can lower monthly payments. Rate type (fixed, variable, or mixed) affects predictability, while negotiating the spread can influence the cost. It’s also important to evaluate MTIC (Total Amount Charged), insurance requirements, and existing credit obligations to optimize mortgage terms for your financial goals.

-

In renovating a property in Portugal, it’s crucial to understand local renovation practices, such as obtaining a building license for major works, and to work with reputable local firms. Due to the slower pace of life, project timelines may differ from other countries, so patience and building strong relationships with contractors are essential.

-

Ordinance no. 304/2019 outlines four types of rehabilitation works: small space reorganization (minor internal changes), large space reorganization (significant interior modifications), extension works (increasing building dimensions), and reconstruction works (demolition and rebuilding). Each category has specific requirements based on the impact of changes on the property’s structure and layout.

-

Rehabilitation projects must adhere to regulations on thermal and acoustic insulation, seismic safety, accessibility, and environmental sustainability. These guidelines, detailed in various ordinances, ensure improved energy efficiency, structural safety, and minimal environmental impact. Additionally, Decree-Law no. 95/2019 emphasizes the importance of preserving and enhancing existing properties’ aesthetic, cultural, and architectural value.

-

A construction contract is crucial for legally safeguarding both the homeowner and contractor. It clarifies terms like execution timelines, payment schedules, and materials, ensuring everyone is aligned on expectations and responsibilities. The contract also serves as a point of reference for resolving potential disputes and secures your interests by formalizing all agreed-upon terms.

-

A solid renovation contract should include party identification, the contractor’s credentials, property details, a clear cost breakdown, and an execution timeline. Essential annexes like property layouts, schematic diagrams, and a detailed work description add transparency and provide visual references for the project scope, helping both parties stay aligned.

-

In addition to the contract, homeowners can protect themselves by setting a staggered payment schedule tied to project milestones, verifying the contractor's insurance, and including penalty clauses for delays. These elements ensure accountability and give you leverage to keep the project on track.

-

When buying a property with a pre-approved renovation project, ensure the approvals are still valid, as they typically last one year but can sometimes be extended. If you proceed with the renovation yourself, verify you have the necessary council permits or a declaration of legality for small works to avoid future compliance issues.

-

An architect is essential for major renovations, especially since they handle local authority submissions. Choose an architect with a proven track record, as this can influence project success. They guide the approval process, from the initial architectural plan to technical engineering assessments, managing local bureaucracy to keep your project compliant and aligned with your vision.

-

To connect electricity in Portugal, start by identifying a local provider such as EDP, Goldenergy, or Endesa. Contact them with your ID, NIF (fiscal number), and proof of address to set up an account. In some cases, a technician may need to visit to initiate service. Expect electricity costs between €0.15 and €0.20 per kWh, depending on your provider and usage.

-

If your property has access to natural gas (common in urban areas), contact a provider like Galp Energia, EDP, or Endesa. You’ll need your ID, NIF, and proof of address. A technician will connect your service if required. For properties without natural gas, you can purchase bottled gas (propane or butane) from suppliers at petrol stations or supermarkets, with costs around €25-€35 per 12.5 kg bottle.

-

Water is managed at the municipal level or by private providers. Typically, your lawyer handles the connection, but if not, contact your local municipality with your ID, NIF, and proof of address to set up an account. Average water costs are €1.00-€1.50 per cubic meter, though prices vary by municipality.

-

When selecting a phone and internet provider, consider factors like coverage, contract options, package offerings, and customer service. MEO, NOS, Vodafone, and NOWO are popular providers, each offering packages that may include internet, mobile, and TV services. For temporary stays, look for short-term or pay-as-you-go options. Additionally, read online reviews and ask locals about their experiences to ensure reliable post-service support.